Tackling the culture and climate that is needed to create a thriving innovation environment is complex.

Tackling the culture and climate that is needed to create a thriving innovation environment is complex.

In this post I can only touch on certain points to trigger that deeper examination and offer the stimulus and considerations it needs.

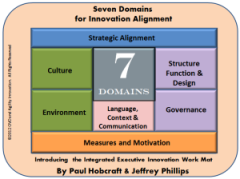

Within the Executive Innovation Work Mat we have seven domains or components that need bringing together to form a new integrated knot.

The aim of the work mat is to draw the senior executive into the innovation process and to support them as they think through what is required to build a more sustaining and integrated innovation understanding within the organization. Their role is a strategic one that sets the conditions and overview on innovation.

Continue reading “Recognizing the conditions for changing innovation in culture and climate”