Thinking about the managing of change has been occupying my mind in recent weeks. It will continue into the next few weeks as Jeffrey Phillips of OVO Innovation and I have co-authored a White Paper called “the critical interplay among innovation, business models and change” as it rolls out.

Thinking about the managing of change has been occupying my mind in recent weeks. It will continue into the next few weeks as Jeffrey Phillips of OVO Innovation and I have co-authored a White Paper called “the critical interplay among innovation, business models and change” as it rolls out.

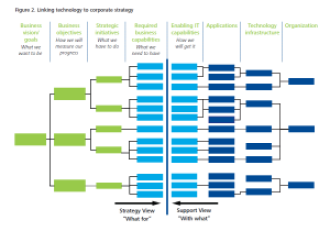

In this we provide a foundation document that highlights the important interplay between innovation, business models and change. To launch this, we have kicked off our thinking with a feature of the week on Innovation Excellence introducing the themes that have multiple interplays we often fail to exploit when it comes to innovation.

The opening post is entitled “the interplay surrounding innovation”. Please take a read

Our opening argument revolves around the recognition of change as part of an interplay

We argue that we are failing to manage the different and multiple interplays that are constantly taking place when innovation occurs. We are often ignoring them and failing to extract the best or optimal value out of the innovation we are introducing. The change effect is often being ignored. Continue reading “The ongoing challenge is making change our constant”