So we all know a standard company balance sheet has three parts: assets, liabilities and ownership equity. The accounting equation states assets and liabilities are known as equity or net worth and this net worth must equal assets minus liabilities. The balance sheet summarises the present position or last audited position.

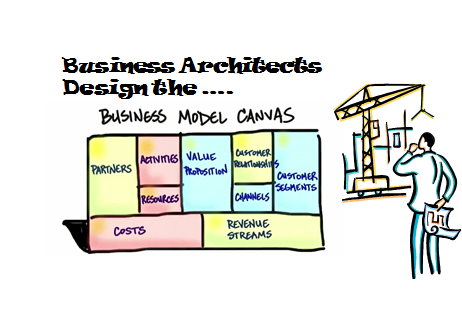

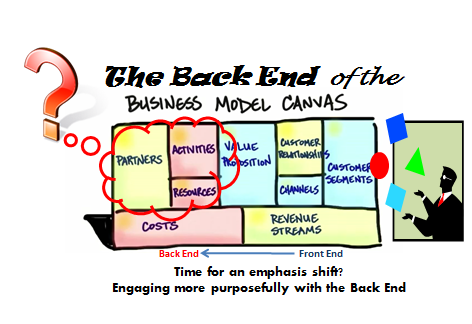

Well in the Business model canvas we have the cost side, the back-end, made up of the activities, resources and partnership aspects and a revenue side, the front end, made up of customer segments, channels and customer relationships. It is the ‘net worth’ of all these blocks that makes up their contribution to the Value Proposition.

It is the nine building blocks when we put them together, tells the complete story, a little like a business model balance sheet. Balancing this out thoughtfully does need that bringing it all together, so as to give others the compelling story and begin to mobilise around and attract the necessary resources.

My question though is this: “is the BMC understated at the back-end today and should we strike a different balance for more established organizations?”

BMC model is by Osterwalder & Pigneur. Visual source: Steve Blank

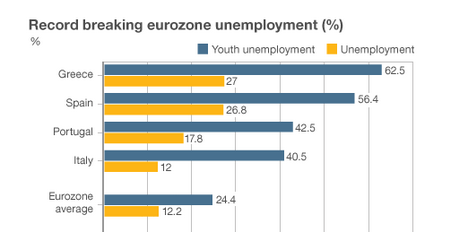

What happens when one side perhaps gets over emphasised?

Very much the orientation of the business model canvas is presently skewed towards the front end – the market facing part and rightly so. You are in search of a new business model, you will never find it in the building. As Steve Blank rightly stated “you have to get out of the building” to validate your assumptions or hypothesis, to search for the value in the real marketplace.

Continue reading “The Understated Back-End of the Business Model Canvas.”