Let’s admit it, our middle management needs a radical makeover, a new fitness regime to make us far more innovation fit.

Let’s admit it, our middle management needs a radical makeover, a new fitness regime to make us far more innovation fit.Continue reading “Redesigning the organizations middle for a new innovation shape.”

Building Your Innovation Intelligence

Bringing my thinking and solutions to your problems

Let’s admit it, our middle management needs a radical makeover, a new fitness regime to make us far more innovation fit.

Let’s admit it, our middle management needs a radical makeover, a new fitness regime to make us far more innovation fit. We were not born as risk-takers but we can develop it through our own growing self-actualization, creativity, a pursuit for growth and enjoying that feeling of being stretched, going beyond your normal scope of reach.

We were not born as risk-takers but we can develop it through our own growing self-actualization, creativity, a pursuit for growth and enjoying that feeling of being stretched, going beyond your normal scope of reach.

Well some of us do, but sadly most tend to become risk-avoiding because of the environment they are in or have been associated with for long periods, where avoidance rubs off, it seeps into the soul.

Many enjoy being simply ‘passive’, avoiding anything that smacks of being ‘proactive’; it is safer to be ‘reactive’. Innovation and heaven can equally wait.

Putting it simply most people and organizations are just afraid to take risks and this fear takes over and drives their choices. Innovation is certainly something that suffers from this fear of risk.

Organizations miss critical opportunities, individuals fail to speak out and argue for a given change or innovative idea. We can simply stop growing, to want to become something more, we take the easy option, we avoid risk.

Continue reading “Risk Is Understanding Your Scope of Reach Should Exceed Your Grasp.”

Following on from my last post of “Place your future bets- invest in Innovation Capital” which outlined the significant contribution innovation capital plays in our economic growth and value enhancement, let’s explore some more.

Let me offer some further thoughts on its value to really capture and understand, so we can measure it within our organizations.

We have the three components; of physical capital, knowledge capital and human capital that are the innovation-related assets, these make-up Innovation Capital.

I have been arguing that innovation capital draws from the core of intellectual capital and its suggested (and broadly recognized) components of human, structural and relational capitals or social capital.

I have previously discussed this converging up, as the ‘nesting effect’

Innovation capital needs assessing and measuring so we can understand the relationship between these innovation capitals (and their present and future potential) and organization performance. We need to know the innovation capital ‘stock’.

Why, well ‘stock’ can be ‘static’ and we need to make this more ‘dynamic’ so innovation can ‘flow’ from this constant renewing of our capitals and be transformed into new value.

Continue reading “Exploring the Value Of Your Innovation Capital”

Recognizing the value of our innovation-related assets is where the smart money should go, and then we need to invest in innovation capital. To gain growth and improve productivity is through innovation. We need to translate knowledge into new values.

Recognizing the value of our innovation-related assets is where the smart money should go, and then we need to invest in innovation capital. To gain growth and improve productivity is through innovation. We need to translate knowledge into new values.

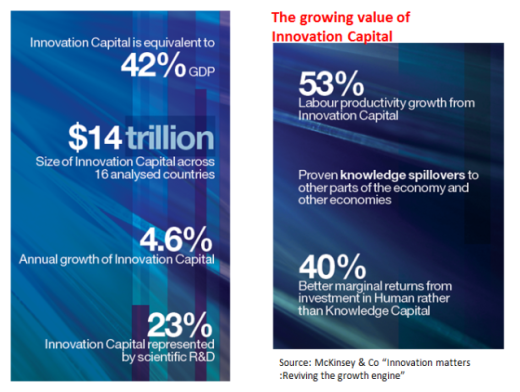

When you pause and consider the make-up of Innovation Capital you realize it makes such an economic contribution and in a report from McKinsey & Co, they have set about identifying this to produce the above summary, covering 16 countries, to understand the real value of this Innovation Capital.

These numbers are big and still don’t fully capture everything associated with innovation as much remains ‘hidden’ or ‘attached’ to other activities as well.

We need to shift our thinking on what makes up Innovation Capital

Continue reading “Place Your Future Bets – Invest In Innovation Capital”

Often innovation succeeds or fails by the personal involvement and engagement of a ‘selected’ few- they make it happen as they are the heavyweights that have the final say.

We all need to recognize the type of innovative leadership personality within our organization, the ones we are working for, as this might help you manage the innovation work a whole lot better and attract the resources you need.

So can you recognize the traits of your innovation leader?

Are they front-end or back-end innovation leaders? Here’s how you can begin to spot the difference.

Continue reading “Recognizing your type of innovation leader”

Most rooms we enter have four sides and are traditionally built on a standard four-pillar design; they provide the structure to build upon.

Most rooms we enter have four sides and are traditionally built on a standard four-pillar design; they provide the structure to build upon.

Presently in many of our economies, particularly in the West, we are struggling to find real growth; we are limited in our wealth-creating possibilities.

Why is that? Our structures seem to be weak, not strong. Continue reading “Building upon four key wealth creating pillars”

The future within our engagements will determine diffusion and adoption- part three

The future within our engagements will determine diffusion and adoption- part three

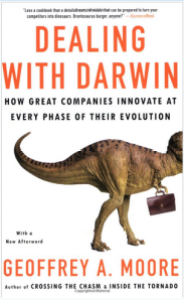

One of my favorite books is “Dealing with Darwin– how great companies innovate at every phase of their evolution” written by Geoffrey Moore. It is well worth a read.

When you work through his other books and connect thinking of “Crossing the Chasm” and “Inside the Tornado” you really appreciate the learning stories coming out of Roger Moore’s studies of the Technology Adoption Life-Cycle.

We all need to rethink a lot as the new challenges come rushing towards us.

In his work, Geoffrey Moore talks about ‘traction’ and I think this is a great word for thinking about how to gain diffusion and adoption in product, service or business models, to gain market and customer acceptance.

Continue reading “Exploring Diffusion and Adoption for Innovation – Part 3”

The future within our engagements will determine diffusion and adoption

The future within our engagements will determine diffusion and adoption

It is all about letting go but also grabbing more at the same time, and then finding ‘it’.

Technology has opened up the door to both scale and fragmentation and social business is the one pushing through this open door.

We are increasingly facing the Collaborative Economy everywhere we turn. Social business is becoming the denominator of success or failure.

We are needing to confront the new questions that are emerging

New rules are emerging – you could say new theories – and where are these fitting within the corporate mindset?

Continue reading “Exploring Diffusion and Adoption of Innovation – Part 2”

The future within our engagements will determine diffusion and adoption- part one.

The future within our engagements will determine diffusion and adoption- part one.

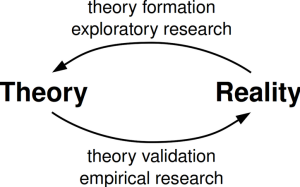

According to Professor Clayton Christensen and drawn from his book “Seeing What’s Next: Using the Theories of Innovation to Predict Industry Change”, by Clayton M. Christensen, Scott D. Anthony, and Erik A. Roth published by Harvard Business School Press, the only way to look into the future is to use theories.

“The best way to make accurate sense of the present, and the best way to look into the future, is through the lens of theory.” The theory of innovation helps to understand the forces that shape the context and influence natural decisions.

This might not be fashionable for many because as soon as you introduce “theory” into the discussion for many of my practical colleagues they want to dismiss it.

Going back to Christensen “good theory provides a robust way to understand important developments, even when the data is limited. “Theory helps to block out the noise and to amplify the signal”.

Diffusion of Innovation Theory is important for our innovation understanding

Continue reading “Exploring Diffusion and Adoption for Innovation – Part 1”

There is no question the Stage-Gate process has had a significant impact on the conception, development and launch of new products.

There is no question the Stage-Gate process has had a significant impact on the conception, development and launch of new products.

Yet there have been consistent criticisms of it, as the world of innovation has moved on. Today it is faster-paced, far more competitive and global and become less predictable.

The cries of the Stage-Gate process as being too linear, too rigid and far too planned, bordering on prescriptive have often been heard. The gates are too structured and the constant ‘creep’ of the controlling bureaucracy surrounding it in paperwork, checklists and justification has simply led to so much non-value-added work added to the moans and groans.

Surprisingly, the Stage-Gate concept was created in the 1980’s and led to Robert G Cooper’s different evolutions of this evolving and absorbing many new practices and experiences gained by different organizations across this time. Continue reading “Opening up the Stage-Gates to let the new innovating world in?”