Where do you set about to intervene and begin to change the organization’s ability to innovate?

Where do you set about to intervene and begin to change the organization’s ability to innovate?

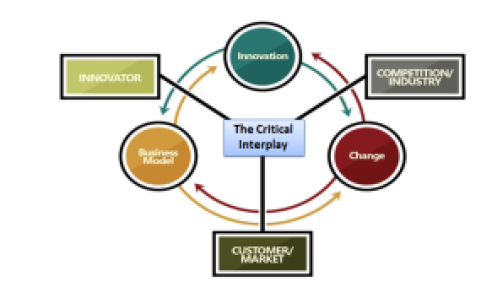

There are seemingly so many intervention points it can get bewildering.

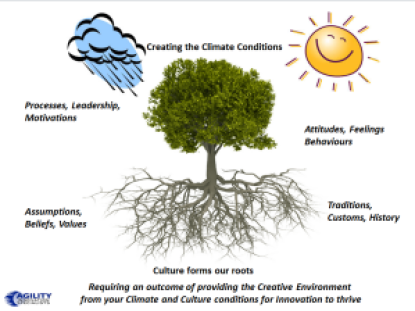

The innovation environment can be made-up of how well you collaborate and network, the level of the group and individual interactions, the presence and commitment of leadership towards innovation, as well as the organizational set-up and structures.

You can explore the make-up of the innovation environment in so many ways.

So what makes up the environment to innovation?

It is the culture, management and its people who have a mutual dependency. Culture can enhance or inhibit the tendencies to innovate, it certainly has a profound influence on the innovative capacity and provides the rich nutrients to nurture innovation or kill it. Culture has always been regarded as a primary determinant of innovation.

Continue reading “Making an impact on an organization’s innovation environment”